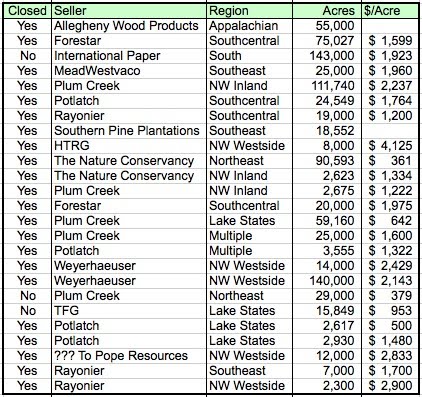

Timberland transactions in the US 2009

-----------------

Major timberland transactions have slowed considerably but some continue to close. I wrote an article for Forest Landowners Magazine (THE TREND IN TIMBERLAND PRICES) that was supposed to be published in October but the publishing date was postponed until late November so I thought I would do a little update on transactions to date for this year. From the list below, you can see that there are quite a few transactions but relatively few large ones.

Here is an insightful comment from Plum Creek's 3rd Quarter Earnings Conference Call. "We have not noted any significant changes to our rural land markets since the last quarter's call. In general, rural land values were off approximately 25% in higher value regions such as Florida, portions of Georgia, and Montana. Rural land sales in lower priced markets such as Mississippi and Northern Wisconsin remain fairly active. Prices in these markets have been more resilient and appear to be off 15% or less from their peaks." The comment is supported by the Rayonier sale above for $1,200 per acre which is a conglomerate of sales showing that Florida is definitely a soft area. Some of the other companies are reporting very little decline in the rural/recreational market.

In spite of these stated declines, there remains little sale activity supporting significant declines in institutional timberland values. Several of the larger timberland sales were at a solid price but there are too few to say prices have not declined. Perhaps the most interesting thing about this list is the names of the sellers. They are almost ALL public companies selling land to try to protect their dividends (or in Forestar's case, the entire company!). The one TIMO sale was at a very good price.

Copyright:Issued by: The Timberland Blog

Author: J Brian Fiacco

e-Mail:

Issue date: October 31, 2009

Link to Article: Origin of text

---------------