International wood pellets markets - a retrospection on 2008

-----------------

The use of wood pellets as fuel for domestic stoves and boilers and for co-firing in thermal power plants has been an amazing success story over the past 10 years. Recently, the exorbitant speed of growth caused supply problems and a slowdown of markets, but the next boom is waiting, says Christian Rakos.

High oil prices in the autumn of 2005 accelerated sales of pellet-fired stoves and boilers, while a very cold winter in Europe created both stronger demand and a significant shortage of raw material for pellet production. With wood harvesting at a standstill due to the extremely low temperatures and large amounts of snow, the combination of rapidly growing demand and supply-side problems created unexpected shortages of pellets in both European and US markets. A continued shortage of raw material through 2006 finally led to a sharp increase in prices, which rose within a few months from a residential average of [euro]180 per tonne of bulk pellets delivered to [euro]270/tonne. These price increases were experienced in most of the European countries with developed pellet markets, though some younger markets with a small number of market players, such as Ireland, experienced less price volatility.

The effect of this price volatility on market development was significant. Rising pellet prices drew significant media attention and supply shortages knocked consumer confidence in the 'new' product.As a consequence, sales of pellet stoves and boilers dropped for the first time in a decade, both in EU markets and the USA. Pellet producers were also affected by the extremely mild winter of 2006-2007, with the warm weather curbing demand for fuel by about 30% in Europe compared with a typical year, and leaving them with high stock levels.

THE NORTH AMERICAN MARKET SITUATION

Pellets were developed in the USA as a reaction to the energy crisis in the late 1970s and pellet stoves became quite popular during this period in a few forested regions.As energy prices dropped again, pellet markets were quiet for almost 20 years, until, with rising oil prices, the interest in pellet stoves was rekindled. Pellet stove sales grew from 40,000 in 2000 to 150,000 in 2006, putting growing pressure on pellet supply. In winter 2006 significant pellet shortages occurred on both the west and east coasts of the US. Production has recently grown significantly, but the supply situation varies from region to region. The West Coast still tends towards undersupply, over capacity is available in the northern Midwest, while the situation on the East Coast shows a supply-demand balance.

Large distances in the US, coupled with a lack of train transport facilities, make logistics difficult when it comes to moving pellets from those places with oversupply to places with undersupply. Shortages again led to a considerable decline in demand for pellet stoves in 2007.

|

Over the border, Canada is currently the country with the largest potential for the production of wood pellets. The availability of extremely large volumes of trees destroyed by the mountain pine beetle disaster in British Columbia represents a huge resource that could be utilized for pellet production. Ambitious plans to realize large-scale pellet production from these resources have not, so far, materialized, however. As domestic utilization of pellets is still very low in Canada, producers are strongly dependent on exports, mainly to the USA and Europe. Sharply rising shipping rates have made pellet transport to Europe expensive recently and made it more difficult for Canadian producers to compete with European rivals. Export to the USA is also difficult due to high transport costs and the low value of the American dollar. Significant interest has developed recently in Canada to look at the opportunities to use pellets in the domestic market, particularly for commercial heating applications.

THE SCANDINAVIAN SITUATION

Sweden is currently the world's largest pellet market, with overall pellet demand reaching 1.6 million tonnes in 2006. Pellets are used both for residential heating and in large combined heat and power (CHP) plants.The Swedish market also experienced considerable price increases in 2006 and a temporary decline of demand for residential pellet heating systems, and Swedish pellet prices are significantly higher than than those in central Europe at the moment. However, Sweden has very high energy taxes on fossil fuels, making pellets, even at [euro]220/tonne, 50% less expensive than fuel oil.

New data published by the Danish Energy Agency reveals that the Danish market development has been strongly influenced by changes in that country's political framework conditions. During the late 1990s the Danish market for residential pellets boilers was one of the most dynamic markets in Europe.A sudden change of policies was introduced by a new conservative government, which cancelled all subsidies for renewable energies.This led to an immediate decline in the market after 2000. Between 2004 and 2006 the demand for pellets for residential heating increased again and grew by about 200,000 tonnes. Pellets are also used extensively in district heating plants and power plants in Denmark. Given limited domestic wood resources, straw pellets are also used here, and the amount of imported wood pellets is growing significantly.

THE UK AND IRELAND

Ireland is an interesting example of how fast a market can be established by financial incentives. Pellet heating in Ireland was virtually non-existent when in March 2006 the Greener Home Scheme was implemented.This subsidy scheme offered [euro]4200 grants for pellet boiler installation, [euro]1800 for pellet central heating stoves and [euro]1100 for pellet stoves. Within one year 4000 applications were submitted to the scheme, although the number of realized projects was lower. Nevertheless, according to Sustainable Energy Ireland, 1900 pellet boilers, 240 central heating stoves and 330 stoves were installed between April 2006 and August 2007.Another subsidy scheme implemented for commercial use of pellets, the Renewable Heat Programme, offers subsidies of up to 30% for commercial applications of biomass.Within a year 52 projects were realized and further 74 applications for the programme accepted. In many cases the projects are in a power range of 500 kW to 2 MW.

However, one problem for the Irish market is that there is only one producer of pellets. Even though this producer has a very modest pricing policy, a wider supply base is required to give consumers confidence of supply.At present three further pellet production projects are in the process of being planned with an overall production capacity of 150,000 tonnes and pellets are also offered by various importers. Typically for a new market, inconsistent pellet quality and some poor-quality boilers introduced by local companies with no experience of working with the new fuel have created some problems.With the fundamental role of quality in sustained market success not properly understood by all players in an immature market, public policies can be helpful to establish quality criteria for subsidies, training courses and standards.

At present pellets are used in the UK predominately in power plants - their use in single family households is negligible. The market for larger biomass boilers suitable for heating residential blocks or larger buildings has been more promising. In many cases these boilers use wood chips rather than pellets, however.At present only small amounts of pellets are being produced in the UK although this is set to change - estimates suggest that by 2010 about 400,000 tonnes of pellets could be produced in the UK annually.

A number of political initiatives could speed up the development of pellet use in the UK. For instance, a rapidly growing number of local authorities are starting to apply the so-called Merton Rule.This rule, which was introduced in the London suburb of Merton, requires all new building projects with more than 1000 m2 of usable space or more than 10 individual buildings to source at least 10% of their energy requirements from renewable sources. Such a ruling forces the construction industry to consider the different possibilities of renewable energy in residential construction and it may be expected that the industry will quickly realise that in terms of a cost-benefit relationship, pellet heating performs much better than most other options.

From April 2008 to 2011 an extensive carbon emission reduction target programme will be carried out in the UK with overall budget of #3.2 billion ([euro]4.3 billion). The goal of the programme is to realize a significant reduction of greenhouse gas emissions by households.The programme is to be carried out by utilities that have full freedom to realize a range of different measures.Again, it may be expected that utilities will quickly realise where the cost effective opportunities are and focus on pellet heating projects.

The UK government is also presently considering a subsidy scheme for renewable heat.This move has been influenced by the prospect of the upcoming renewable energy directive from the European Union, which will create the first incentive to use renewable heat at EU level.

The future use of pellets in the power markets in Great Britain could be very significant, too. It is, however, highly dependent on the regulatory framework and financial incentives. The regulatory framework conditions for biomass co-firing have still not yet been established.

CONTINENTAL EUROPE

In France the first official statistics for the sales of pellet boilers have been recently published by the French Energy Agency ADEME. According to these statistics, 210 pellet boilers were sold in France in 2004 while in 2005 and 2006 this figure grew to 895 and 4690 respectively. French pellet production in 2006 reached 120,000 tonnes and was expected to grow to 200,000 tonnes in 2007.The demand for pellet boilers was initially restricted to the eastern parts of France, which were influenced by the booming German market, but the use of pellet boilers is now starting to grow in Central and Western France. Many established pellet boiler producers - most of them Austrian - have entered the French market where the political framework conditions are beneficial. Pellets and pellet boilers are subject to a reduced VAT rate of 5.5%, and 50% of pellet boiler costs can be deducted from income tax payments. In addition, regional subsidies are available. France has a large potential to exploit pellets due to the significant forest coverage and the large traditional use of wood.

As in France,Austria has played a key role as a pioneering market for residential use of pellets in boilers. This role developed from more than 20 years of R&D in woodchip combustion, which could be immediately applied to pellets as soon as the new fuel appeared on the market. It was Austrian companies that introduced pellet boilers to Germany and several other European countries and no country has a comparable level of market penetration of pellet boilers. In 2006 some 12.5% of all sold boilers for residential use were pellet boilers.

Austrian pellet production has been growing continuously and will exceed 1 million tonnes in 2008.The current political discussion on carbon dioxide reduction in Austria could lead to increased financial incentives that, together with the ongoing oil price rally, can be expected to again show significant market growth in 2008.

Due to the ample supply of high quality pellets from Austria, a booming pellet stove business was also able to develop in Italy. According to recently released data from Italian stove producers, some 90,000 pellet stoves were sold in Italy in 2005. In 2006 this figure had increased to 220,000 stoves making the country currently the largest market for pellet stoves worldwide.The volume and speed of growth on the Italian market shows the huge potential of pellet stoves, particularly if the economic framework conditions are attractive. Due to high taxes on oil and gas, pellets have been particularly economic in Italy, where the pellet imports from Austria play an important role in market supply. With the fragmented structure of saw mill and wood working industries in Italy leaving the domestic pellet production industry also fragmented into many small producers, further growth in imports can be expected.

MARKET FUNDAMENTALS

The pellet market is a very young market and its extremely rapid growth has inevitably led to a number diverse problems. These issues, such as quality problems, lack of know-how, the emergence of profit hunters, and a lack of market transparency, are typical for emerging markets. In contrast to other renewables like wind or solar, the pellet business faces not only the issue of selling devices, but also establishing sophisticated logistics solutions that support fuel supply over large geographic areas. Establishing such a solution is no easy thing, particularly in a market where margins are limited and many other barriers make development difficult. However, a reliable fuel supply is of fundamental importance for further market development and the engagement of a growing number of LPG and heating oil businesses is a promising trend. Such experienced hands will bring professional practice and a long-term view into the pellet supply business together with the resources to establish a reliable supply chain capable of supporting further growth.

Strong growth can be expected with certainty, with political support on the EU level playing a major role for the extension of pellet business into new member states. The ambitious EU target of achieving 20% of energy supply from renewable energy by the end of 2020 is impossible without dedicated policies to develop renewable heating. In addition, the on-going oil price rally and carbon dioxide reduction targets have a similar effect on expanding markets for pellets.

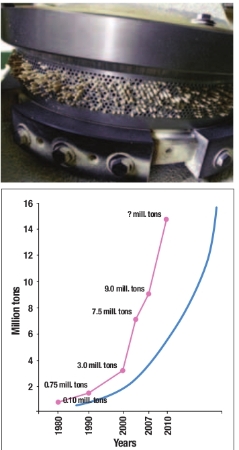

The production of pellets is an easy, low-cost option for upgrading biomass to a dense, homogenous and transportable fuel and offers considerable advantages over other biomass resources. For instance, the overall net energy yield of pellet biomass can be up to 10 times that of producing ethanol per unit area. And, while current global annual pellet production amounts to 9 million tonnes, it is expected to grow to some 15 million tonnes by 2010. By 2020, EU pellet demand alone could grow to 150 million tonnes, based on recent assessments from industry players. This sector has a big future.

Copyright:Issued by: Renewable Energy World

Author: Christian Rakos

e-Mail: rakos@propellets.at

Issue date: February 4, 2008

Link to Article: Origin of text

---------------